The top tax rate has been cut six times since 1980 — usually with Democrats' help - The Washington Post

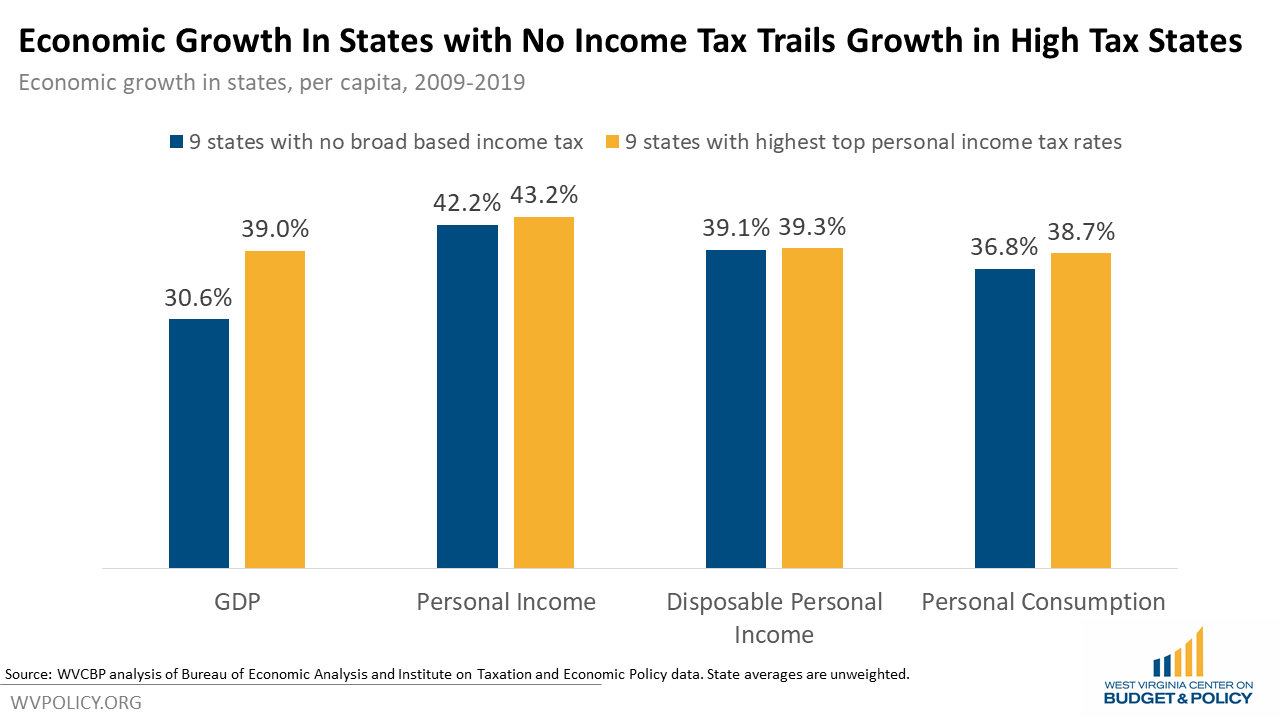

States without Personal Income Taxes are Not Seeing Greater Economic Growth than States with Highest Income Tax Rates - West Virginia Center on Budget & Policy

Chart of the Day: The Inverse Relationship Between the Top Marginal Income Tax Rate and the Tax Burden on 'the Rich' | American Enterprise Institute - AEI

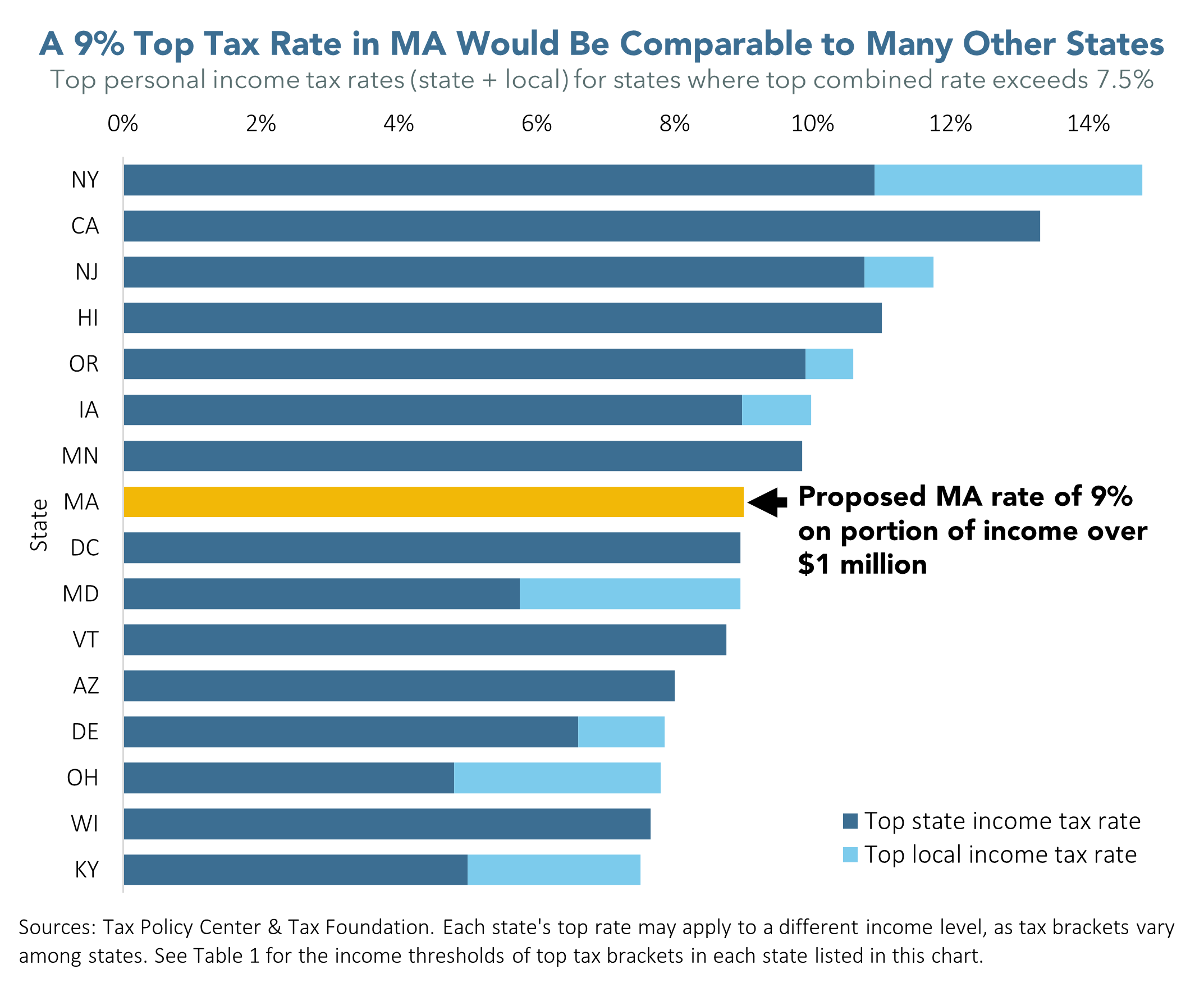

With “Millionaire Tax,” Massachusetts' Top Tax Rate Would Compare Well to Top Rates in Other States - Mass. Budget and Policy Center

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://imageio.forbes.com/specials-images/imageserve/60868250060f8ad8dd0c97eb/0x0.jpg?format=jpg&crop=1200,675,x0,y225,safe&width=1200)

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://specials-images.forbesimg.com/imageserve/60868250060f8ad8dd0c97eb/960x0.jpg?fit=scale)